What Is Corporation Tax Rate . Before the trump tax reforms of 2017, the corporate tax rate was 35%. If you structure as a corporation, you must know the corporation tax rates. A corporate tax, also called corporation tax or company tax, is a direct tax imposed by a jurisdiction on the income or capital of corporations or analogous legal entities. What is corporation tax and how to account for it? An s corporation does not pay corporate tax as the income passes through. State corporate tax rates have also changed. Fifteen states and the district of columbia have cut corporate taxes since 2012 and several more have made tax rate cut in 2020. The tax rate for s corporations is the tax rate for the owners. An aspect of fiscal policy. A corporation, or c corp, is a type of business structure where owners enjoy limited liability protection. What's the corporate tax rate? © provided by the i rishi sunak is reportedly considering raising corporation tax (photo: An s corporation doesn't pay tax as a corporation. The corporate tax rate in the united states is currently at a flat rate of 21%. A company can register as an s corporation to avoid double taxation.

What Is Corporation Tax Rate , Solved: Given The U.s. Corporate Tax Rate Schedule Shown B... | Chegg.com

What's The Use Of Implementing Carbon Tax In Singapore? . An aspect of fiscal policy. Fifteen states and the district of columbia have cut corporate taxes since 2012 and several more have made tax rate cut in 2020. The tax rate for s corporations is the tax rate for the owners. An s corporation does not pay corporate tax as the income passes through. © provided by the i rishi sunak is reportedly considering raising corporation tax (photo: A company can register as an s corporation to avoid double taxation. The corporate tax rate in the united states is currently at a flat rate of 21%. Before the trump tax reforms of 2017, the corporate tax rate was 35%. State corporate tax rates have also changed. An s corporation doesn't pay tax as a corporation. What's the corporate tax rate? If you structure as a corporation, you must know the corporation tax rates. A corporation, or c corp, is a type of business structure where owners enjoy limited liability protection. A corporate tax, also called corporation tax or company tax, is a direct tax imposed by a jurisdiction on the income or capital of corporations or analogous legal entities. What is corporation tax and how to account for it?

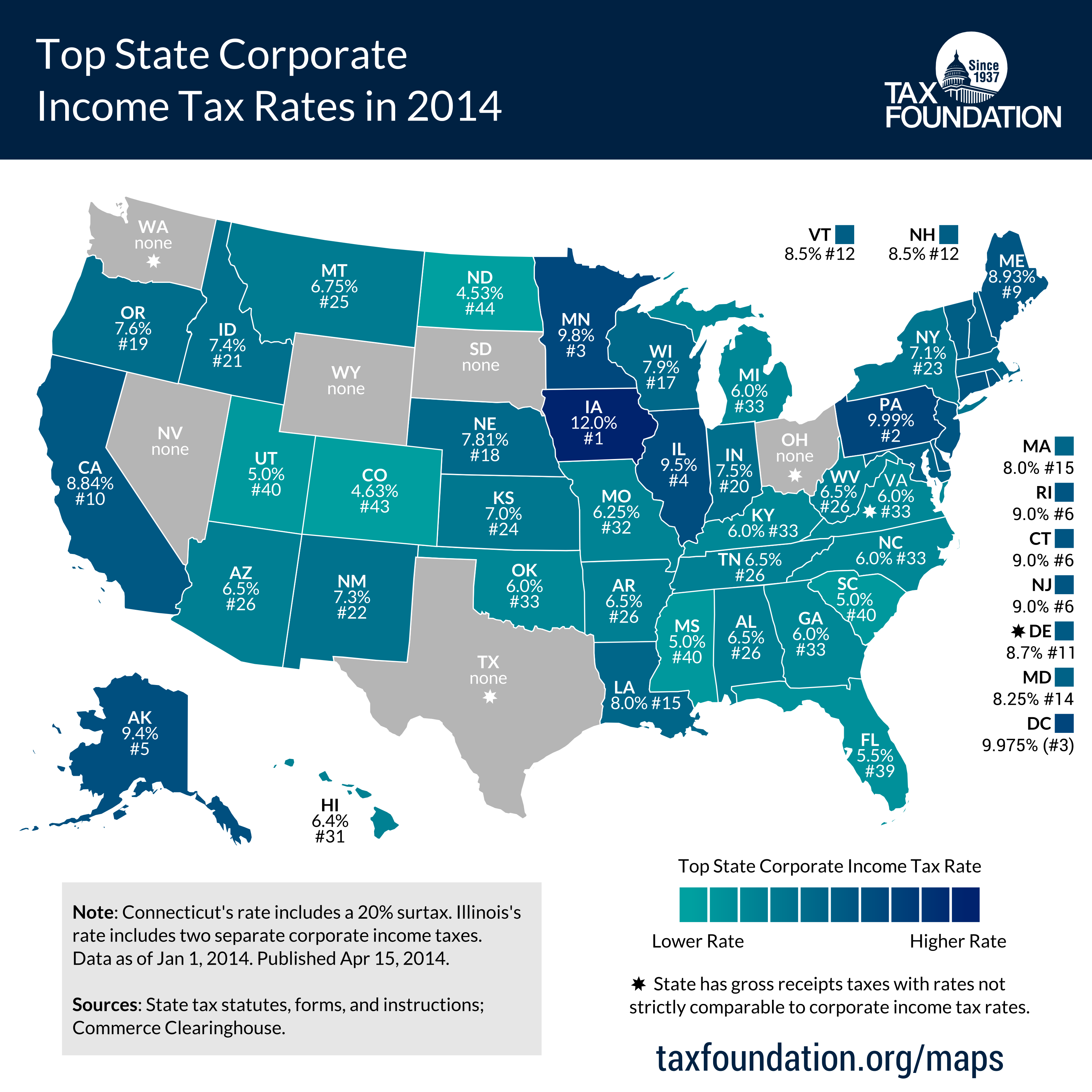

Top State Corporate Income Tax Rates in 2014 | Tax Foundation from files.taxfoundation.org

A form of fair, just and transparent local, regional, national, european or international tax that a business, company, enterprise or organization pays on the amount of profit earned from doing business, income. A corporation, or c corp, is a type of business structure where owners enjoy limited liability protection. As a limited company owner, your company is liable to pay corporation tax on its profits. If more than one rate applies, calculate. Throughout this article, the term pound and the £ symbol refer to the pound sterling. If you structure as a corporation, you must know the corporation tax rates. Corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate enterprises make from their businesses.

What representations she has received on the impact of the abolition of the advance corporation tax dividend on pension funds.

Corporation tax is a tax on the profits of limited companies. Taxpayers with tax years ending on or after july 1, 2017, and before june 30, 2018, must divide their total net income between the periods subject to different rates. A corporation, or c corp, is a type of business structure where owners enjoy limited liability protection. Company tax or corporation tax is very important to us and it is up to each country to set its own rate. Corporate taxes (also known as business income taxes) are taxes that apply to the gross income of taxable businesses. There are different corporation tax rates for companies that make profits from oil extraction or oil rights in the uk or uk continental shelf. The company (not hm revenue and customs) will work out how much corporation tax is payable on the profits. © provided by the i rishi sunak is reportedly considering raising corporation tax (photo: An s corporation doesn't pay tax as a corporation. An aspect of fiscal policy. An s corporation does not pay corporate tax as the income passes through. There is not a global rule that controls the corporate tax rates from one country to the next, but rather, the tax rates are based on the local, federal, and national governments of each country. As a limited company owner, your company is liable to pay corporation tax on its profits. The tax is imposed at a specific rate as per the provisions of the income tax act, 1961. Corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate enterprises make from their businesses. The corporate tax rate in the united states is currently at a flat rate of 21%. This is described as the major rate. The following table shows the income tax rates for provinces and territories (except quebec and alberta , which do not have corporation tax collection agreements with the cra ). The corporation tax rate for company profits is 19 per cent. Find out more about how to pay and the rates from previous corporation tax is paid at the rates that applied in your company's accounting period for corporation tax. 9 things s corporation owners need to know about income and tax rates 3. Get latest news on corporation tax, corporate tax rate, corporate tax cuts, corporate tax in india, corporate income tax on corporation tax is a direct tax imposed on the net income or profit that enterprises make from their businesses. Information for corporations about federal, provincial and territorial income tax rates. 22, 2021 to the tax foundation database on corporate tax rates. Fifteen states and the district of columbia have cut corporate taxes since 2012 and several more have made tax rate cut in 2020. What are the corporation tax rates? That's the lowest rate since 1938, but the effective corporate rate is even less. We have put together this. Rates for corporation tax years starting 1 april. Companies use everything in their disposal within the tax code to. Definition of corporation tax rate in the definitions.net dictionary.

What Is Corporation Tax Rate . The Corporation Tax Rate For Company Profits Is 19 Per Cent.

Source: www.researchgate.net

As a limited company owner, your company is liable to pay corporation tax on its profits. Mean Marginal Corporate Tax Rate and Mean Effective Capital Tax Rate. | Download Scientific Diagram

Source: static1.businessinsider.com

Company tax or corporation tax is very important to us and it is up to each country to set its own rate. Trump tax plan, corporate tax rate among OECD countries - Business Insider

What Is Corporation Tax Rate . Iceland Corporate Tax Rate 2020. | Take-Profit.org

Source: images.contentstack.io

Company tax or corporation tax is very important to us and it is up to each country to set its own rate. Why Rishi Sunak is hiking corporation tax | The Spectator

What Is Corporation Tax Rate - 2,706 Bse-Listed Companies To Gain From Cut In Corporate Tax Rate | Business Standard News

Source: www.iiea.com

Fifteen jurisdictions do not impose corporate tax. What Apple and Shamrocks Teach Entrepreneurs About Taxes and Business

Source: www.economicshelp.org

The worldwide average statutory corporate income tax rate, measured across 177 jurisdictions, is 23.85. Does cutting corporate tax rates increase revenue? - Economics Help

What Is Corporation Tax Rate , Up To Rs.250 Crore Gross Turnover Their Are Different Rates Of Tax For Different Nature Of Corporate And Different Levels Of Turnover What Is Stopping Corporations From Moving Operations From The Us To Elsewhere When Faced With A Tax Hike?

Source: static.bangkokpost.com

Rates for corporation tax years starting 1 april. Corporate tax rate changes and Half-Year tax filing

Source: media.cheggcdn.com

Get latest news on corporation tax, corporate tax rate, corporate tax cuts, corporate tax in india, corporate income tax on corporation tax is a direct tax imposed on the net income or profit that enterprises make from their businesses. B) Suppose Under The Current Tax Rates In The Unit... | Chegg.com

What Is Corporation Tax Rate . This Is Described As The Major Rate.

Source: www.pyapc.com

There are different corporation tax rates for companies that make profits from oil extraction or oil rights in the uk or uk continental shelf. S Corporation or C Corporation Under the Tax Cuts and Jobs Act - PYA

Source: 876124.smushcdn.com

What is the rate of corporation tax? Corporation Income Tax Rates - Canada 2019 and 2020 - Maroof HS CPA Professional Corporation ...

What Is Corporation Tax Rate , Companies Use Everything In Their Disposal Within The Tax Code To.

Source: media.cheggcdn.com

A form of fair, just and transparent local, regional, national, european or international tax that a business, company, enterprise or organization pays on the amount of profit earned from doing business, income. B) Suppose Under The Current Tax Rates In The Unit... | Chegg.com

Source: cdn.images.express.co.uk

Corporate income tax, or corporation tax, is a tax that c corporation legal entities must pay. Super-deduction Budget: What is the super-deduction scheme, how much tax could you save? | City ...

What Is Corporation Tax Rate . The Corporation Tax Rate Which Is Likely Relevant To You Is The Small 20% Profit Rate.

Source: econotb.files.wordpress.com

As a limited company owner, your company is liable to pay corporation tax on its profits. Little-Known Fact: Corporate Tax Rates Have Been Decreasing for Decades | Economics on the Brain

Source: www.forbesindia.com

The rate of corporation tax you pay depends on how much profit your company makes. What the corporate tax cuts mean for India, in four charts | Forbes India

What Is Corporation Tax Rate . Fifteen States And The District Of Columbia Have Cut Corporate Taxes Since 2012 And Several More Have Made Tax Rate Cut In 2020.

Source: s.yimg.com

The current corporation tax rate in the uk is 19% for company profits from 1st apr 2019. What Is Tax Liability?

What Is Corporation Tax Rate , Companies Use Everything In Their Disposal Within The Tax Code To.

Source: upload.wikimedia.org

The following table shows the income tax rates for provinces and territories (except quebec and alberta , which do not have corporation tax collection agreements with the cra ). How high are high taxes? | The Blog by Javier

What Is Corporation Tax Rate , A Company Can Register As An S Corporation To Avoid Double Taxation.

Source: theaccountingandtax.com

The corporate tax rate has been lowered from 35% to 21%. What is the Corporate Tax Rate in Canada in 2019? | The Accounting & Tax

Source: www.iiea.com

Fifteen jurisdictions do not impose corporate tax. What Apple and Shamrocks Teach Entrepreneurs About Taxes and Business

Source: www.researchgate.net

Corporation tax is a tax on the profits of limited companies. Effective Tax Rates of Corporate Sector, 2014-15 | Download Table

Source: i.inews.co.uk

Corporate taxes (also known as business income taxes) are taxes that apply to the gross income of taxable businesses. What is corporation tax and who pays it? How a Budget 2021 rate increase would affect UK businesses

Source: image.assets.pressassociation.io

Company tax or corporation tax is very important to us and it is up to each country to set its own rate. Corporation tax will increase to 25% from 2023 | This Is Wiltshire

Source: marketbusinessnews.com

Fifteen jurisdictions do not impose corporate tax. Corporate tax - definition and meaning - Market Business News

Source: mycpa.net

What representations she has received on the impact of the abolition of the advance corporation tax dividend on pension funds. New Tax Changes for 2018 - Tax Cuts and Jobs Act | MyCPA.net

Source: study.com

If more than one rate applies, calculate. Corporate Tax Rate: Definition & Formula - Video & Lesson Transcript | Study.com

Source: www.tyrepress.com

This relates to businesses with a yearly maximum profit of £300,000. Budget 2021: Corporation tax up, but business rates frozen - what it means for tyre businesses ...

Source: www.coursehero.com

Definition of corporation tax rate in the definitions.net dictionary. Assume that the corporate tax rate is 34 and the personal tax rate is 30 The

Source: marketbusinessnews.com

As a limited company owner, your company is liable to pay corporation tax on its profits. Corporation tax - definition and meaning - Market Business News